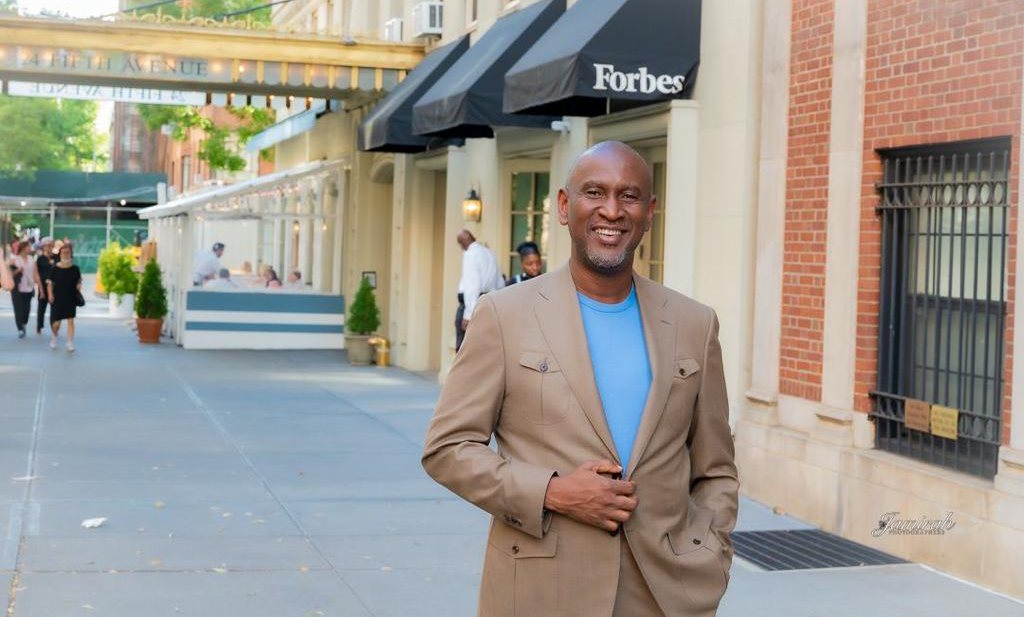

Next to the pool on the rooftop of the Amsterdam W Hotel, Dick Veerman met with Nigerian-born and bred tech investor and CEO of an innovation-based oil and gas company Akintoye Akindele. Dr Akindele says he is an agnostic investor. He’ll invest in any sector, country, and continent as long as it promotes wellbeing, inclusiveness and dignity for human beings while shaping Africa’s destiny on the global scene. He believes business rather than government will help move societies forward and make them more sustainable. What is his recipe?

Dr Akindele (48) was trained as a technical engineer. He worked as a banker and acquired his investment banking and private equity engineering skills early in his career on the global scene. In Amsterdam, he was talking about gas, and at the moment my continent and country, The Netherlands, suffers from a gas crisis. Russian state-controlled gas company Gazprom’s ‘maintenance’ of the Nord Stream 1 pipeline is causing soaring gas prices and, as a consequence, electricity prices have risen in the EU.

Further, Dr Akindele is also the founder and chairman of Platform Capital, a venture capital firm. It focuses on providing both principal investment and advisory for startup firms and investors in Africa. Platform Capital invests in the African tech ecosystem linking it back and forwards to start-ups outside of Africa.

Dr Akindele stresses the importance of entrepreneurship in Africa’s evolution. I asked him how Platform structures its ventures.

“We’re obsessed with the future’, says Dr Akindele. “It belongs to those who create it. We are keen on ensuring that African Africans are active in our common future that citizens all over the globe will live in.“

Dr Akindele explains that Platform’s center of gravity is Africa, but that the firm's job is to partner with technology companies outside Africa to re-include Africa in the world Europeans created about a thousand years ago. Doing so it should enable and empower Africa to create its own sustainable destiny based education, economics and ecology. “And the Earth”, stresses Dr Akindele, “and all the E’s in between, because there is no future if isn’t sustainable or if it doesn’t offer human beings equal opportunities”.

The investor makes a passionate point of the importance of Africans creating their own narrative. He wants Africa to be ruled the way Africans rule and is proud of the science and medicine “the older African heritage has brought to the world. For after all, we all stem from Africa.” Dr Akindele is as passionate about promoting inclusiveness for every single human being. Every citizen in the world should be empowered to express her or his uniqueness.

Platform's trick is to bring together people from the companies the firm invests in. They learn how to do and develop business and sustainable innovation collectively. They learn to make links between their businesses and attract new business. That’s not just about investing in creating returns, but about creating an ecosystem of companies with an extra component: a surplus growth and returns potential emanating from the drive to serve society by an integral approach.

Yet, Dr Akindele says, “this is beyond revenue and profits. It creates the future in a balance between people, the planet and profits. It’s way beyond just returns on capital.”

"It’s our children’s new global world in which we can all engage as global citizens", says Dr Akindele, who isn’t much of a believer in the effectiveness of government policies. People who believe in the cause of world citizenship can be “like an army that can help the world through the dangerous times we live in”, he says.

“Human beings have dignity. We’re far stronger than we realize. Together we can build a global world”, confirms Dr Akindele, who states clearly that he’d rather stay away from politics and geopolitics as “luxuries he cannot afford”. He would rather “build a better global world that’s one and in which we’re all empowered to be kings in our right”, is his systematic response to my questions concerning politics, government policies and geopolitics by foreign continents in Africa and the world. “You may call me a dreamer, but that’s what we really need right now.”

Platform invests in Africa, as well as in Latin America, the US, Europe and Asia. Usually with a link to Africa, but sometimes on itself as the African networked ecosystem will benefit from it. Dr Akindele believes in long-term investments that’ll sit for 12, 13 or even 15 years on a company’s balance sheet. He stresses the importance of patient capital to help companies fully develop, scale and consolidate and cites the examples of Google, Facebook, Amazon and Microsoft. The long and patient capital is provided for about 90% by the Platform itself.

Dr Akindele's ambitions are huge. He now invests, both directly and indirectly, in a few hundred African companies. He intends to empower 1 million African enterprises, about one-third of a percent of the current number of 330 million SMEs in Africa. The opportunities are there as Africa has a young population, and its markets are far from being covered. And because Africa is rich, it supplies the world with minerals (such as lithium and cobalt for high-tech equipment and gadgets like your iPhone), fuels and special foods such as cocoa and coffee.

Platform Capital is looking for new tech partners to invest in and for financial partners to co-invest and get acquainted with Platform’s business campuses, where the network and co-investors meet in several African countries and in the US (Dallas and San Francisco). A new campus is to open soon in London.

A modular gas refinery

A main asset in Dr Akindele’s portfolio is natural gas reserves. But it doesn't stop there. He is CEO of Duport Midstream Company, an energy company developing an energy park in Nigeria with a modular refinery, gas processing plant, CNG plant, storage terminal and power plant. The concept is replicable in different places and has a number of huge advantages. Locally, it provides Nigeria with cleaner energy than wood and permits the country to use its own energy resources directly at the source. And as it doesn’t flair methane, it doesn’t spill scarce energy but turns it into a usable gas as well. That reduces the carbon emissions of processing the already cleanest type of fossil fuels. “Of course”, Dr Akindele says, “we need to go renewable. But we won’t have enough of it for a long time as you know as well. So let’s emit far less carbon first. That’s why we need to have the cleanest possible fossil energy in Nigeria.”

The local processing plants permits Nigeria to export CNG to Europe and to my country, the Netherlands. It also means that Nigeria can exploit its own energy resources and benefit better from it financially.

Nigeria has the ninth biggest gas reserves in the world, probably about six times the Dutch reserves. So yes, there’s an opportunity for the Dutch to import Nigerian gas and have Africa make money, proudly, from its own gas reserves. Instead of just pumping up oil, transporting it and refining it in our Botlek-area near Rotterdam to have it turned into an end product at a refinery up North. And there’s an opportunity for Europeans as well: to invest in local energy plants in Africa instead of in Shell.

Further, Dr Akindele is also the founder and chairman of Platform Capital, a venture capital firm. It focuses on providing both principal investment and advisory for startup firms and investors in Africa. Platform Capital invests in the African tech ecosystem linking it back and forwards to start-ups outside of Africa.

Dr Akindele stresses the importance of entrepreneurship in Africa’s evolution. I asked him how Platform structures its ventures.

“We’re obsessed with the future’, says Dr Akindele. “It belongs to those who create it. We are keen on ensuring that African Africans are active in our common future that citizens all over the globe will live in.“

We are keen on ensuring that African Africans are active in our common future that citizens all over the globe will live inPassionate

Dr Akindele explains that Platform’s center of gravity is Africa, but that the firm's job is to partner with technology companies outside Africa to re-include Africa in the world Europeans created about a thousand years ago. Doing so it should enable and empower Africa to create its own sustainable destiny based education, economics and ecology. “And the Earth”, stresses Dr Akindele, “and all the E’s in between, because there is no future if isn’t sustainable or if it doesn’t offer human beings equal opportunities”.

The investor makes a passionate point of the importance of Africans creating their own narrative. He wants Africa to be ruled the way Africans rule and is proud of the science and medicine “the older African heritage has brought to the world. For after all, we all stem from Africa.” Dr Akindele is as passionate about promoting inclusiveness for every single human being. Every citizen in the world should be empowered to express her or his uniqueness.

Platform's trick is to bring together people from the companies the firm invests in. They learn how to do and develop business and sustainable innovation collectively. They learn to make links between their businesses and attract new business. That’s not just about investing in creating returns, but about creating an ecosystem of companies with an extra component: a surplus growth and returns potential emanating from the drive to serve society by an integral approach.

Platform Capital is about creating an ecosystem of companies with an extra component: a surplus growth and returns potential emanating from the drive to serve society by an integral approachGlobal citizenship’s army

Yet, Dr Akindele says, “this is beyond revenue and profits. It creates the future in a balance between people, the planet and profits. It’s way beyond just returns on capital.”

"It’s our children’s new global world in which we can all engage as global citizens", says Dr Akindele, who isn’t much of a believer in the effectiveness of government policies. People who believe in the cause of world citizenship can be “like an army that can help the world through the dangerous times we live in”, he says.

“Human beings have dignity. We’re far stronger than we realize. Together we can build a global world”, confirms Dr Akindele, who states clearly that he’d rather stay away from politics and geopolitics as “luxuries he cannot afford”. He would rather “build a better global world that’s one and in which we’re all empowered to be kings in our right”, is his systematic response to my questions concerning politics, government policies and geopolitics by foreign continents in Africa and the world. “You may call me a dreamer, but that’s what we really need right now.”

Platform invests in Africa, as well as in Latin America, the US, Europe and Asia. Usually with a link to Africa, but sometimes on itself as the African networked ecosystem will benefit from it. Dr Akindele believes in long-term investments that’ll sit for 12, 13 or even 15 years on a company’s balance sheet. He stresses the importance of patient capital to help companies fully develop, scale and consolidate and cites the examples of Google, Facebook, Amazon and Microsoft. The long and patient capital is provided for about 90% by the Platform itself.

You may call me a dreamer, but that’s what we really need right nowEmpowering one million entreprises

Dr Akindele's ambitions are huge. He now invests, both directly and indirectly, in a few hundred African companies. He intends to empower 1 million African enterprises, about one-third of a percent of the current number of 330 million SMEs in Africa. The opportunities are there as Africa has a young population, and its markets are far from being covered. And because Africa is rich, it supplies the world with minerals (such as lithium and cobalt for high-tech equipment and gadgets like your iPhone), fuels and special foods such as cocoa and coffee.

Platform Capital is looking for new tech partners to invest in and for financial partners to co-invest and get acquainted with Platform’s business campuses, where the network and co-investors meet in several African countries and in the US (Dallas and San Francisco). A new campus is to open soon in London.

A modular gas refinery

A main asset in Dr Akindele’s portfolio is natural gas reserves. But it doesn't stop there. He is CEO of Duport Midstream Company, an energy company developing an energy park in Nigeria with a modular refinery, gas processing plant, CNG plant, storage terminal and power plant. The concept is replicable in different places and has a number of huge advantages. Locally, it provides Nigeria with cleaner energy than wood and permits the country to use its own energy resources directly at the source. And as it doesn’t flair methane, it doesn’t spill scarce energy but turns it into a usable gas as well. That reduces the carbon emissions of processing the already cleanest type of fossil fuels. “Of course”, Dr Akindele says, “we need to go renewable. But we won’t have enough of it for a long time as you know as well. So let’s emit far less carbon first. That’s why we need to have the cleanest possible fossil energy in Nigeria.”

The local processing plants permits Nigeria to export CNG to Europe and to my country, the Netherlands. It also means that Nigeria can exploit its own energy resources and benefit better from it financially.

Nigeria has the ninth biggest gas reserves in the world, probably about six times the Dutch reserves. So yes, there’s an opportunity for the Dutch to import Nigerian gas and have Africa make money, proudly, from its own gas reserves. Instead of just pumping up oil, transporting it and refining it in our Botlek-area near Rotterdam to have it turned into an end product at a refinery up North. And there’s an opportunity for Europeans as well: to invest in local energy plants in Africa instead of in Shell.

Related