In the fifth chat of the Digital Food series, Tiffany Tsui asked her panel of African experts about challenges to organize trust, capital and infrastructure for African smallholder entrepreneurs. Victoria Madedor (African Farmers Stories), Babatunde Olarewaju (Futux Agri Consult, Lagos, Nigeria), and Dr Ikechi Agbugba (Rivers State University, Nigeria) discussed the overcoming challenges to trade and export of crops. Marjan de Bock-Smit (founder ImpactBuying, former CEO SIM Supply) responds.

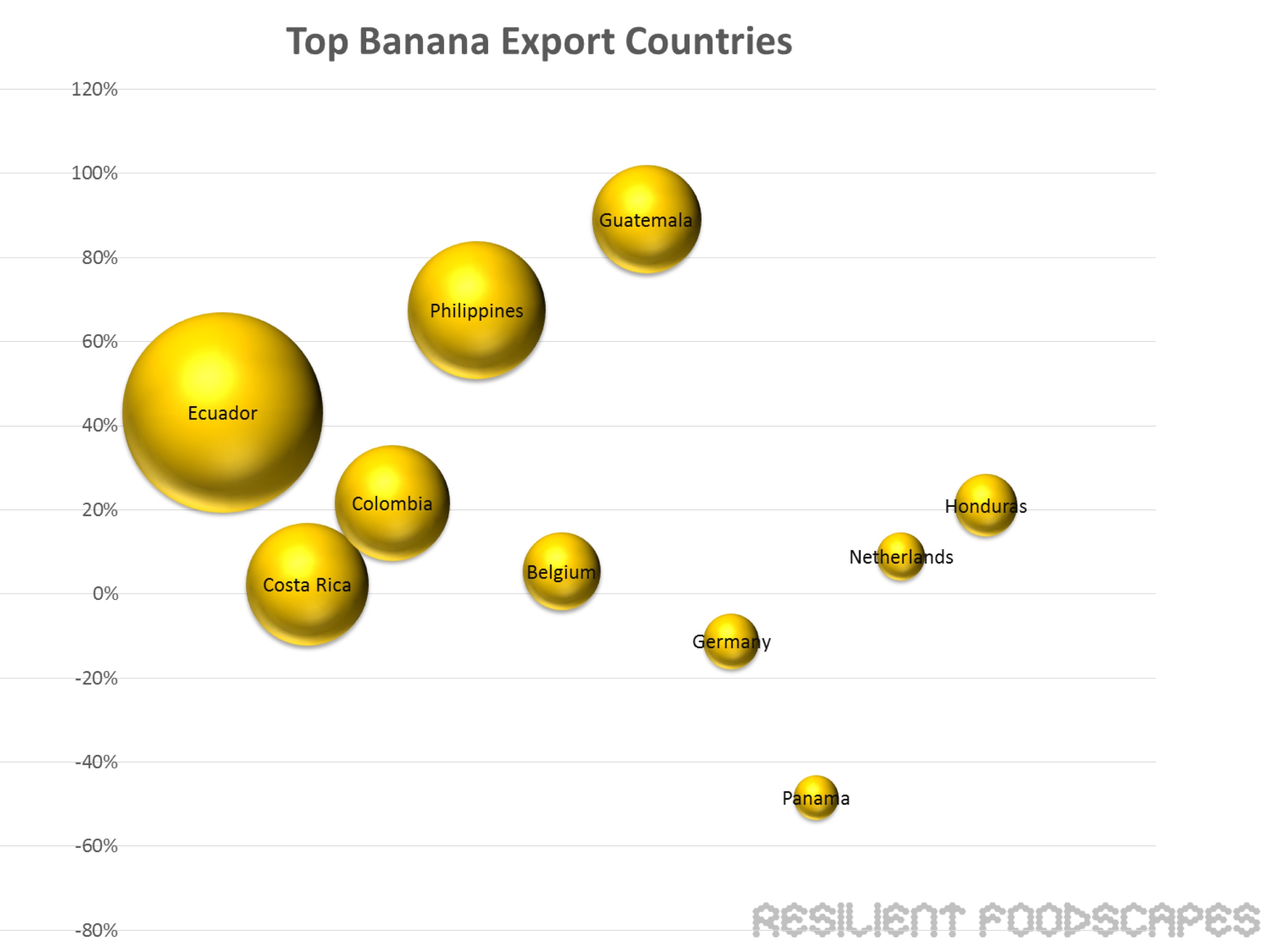

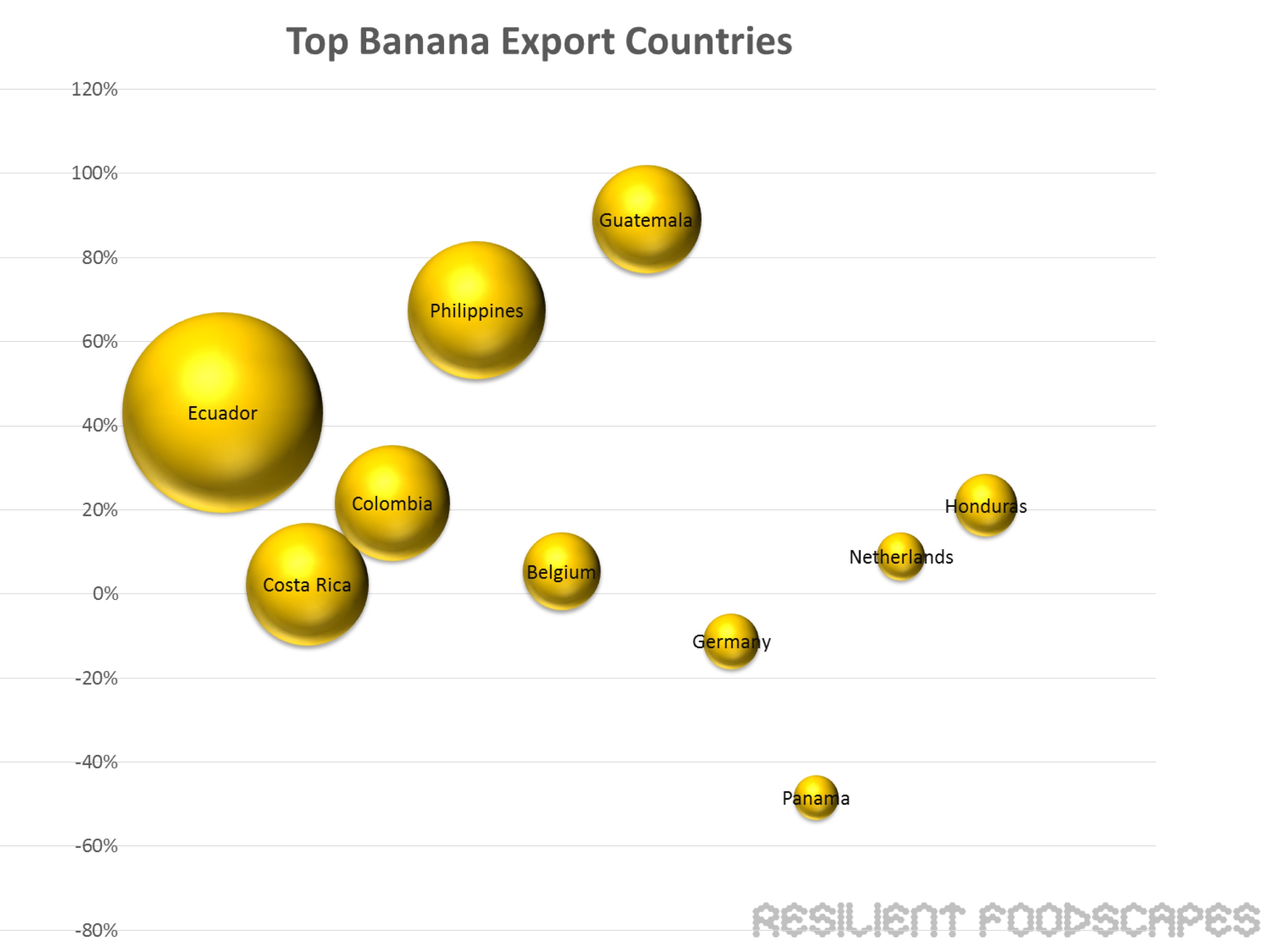

Top Banana exporting Countries

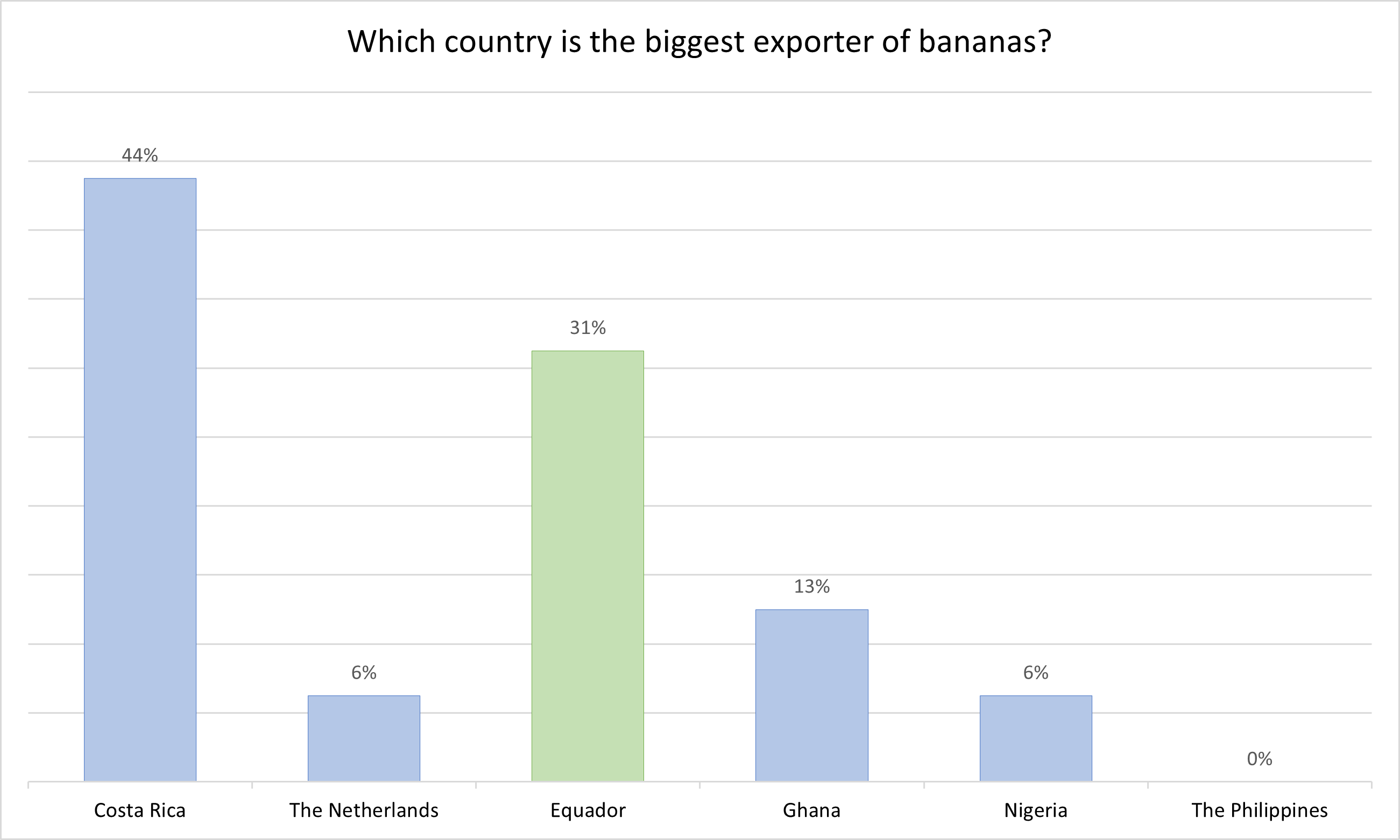

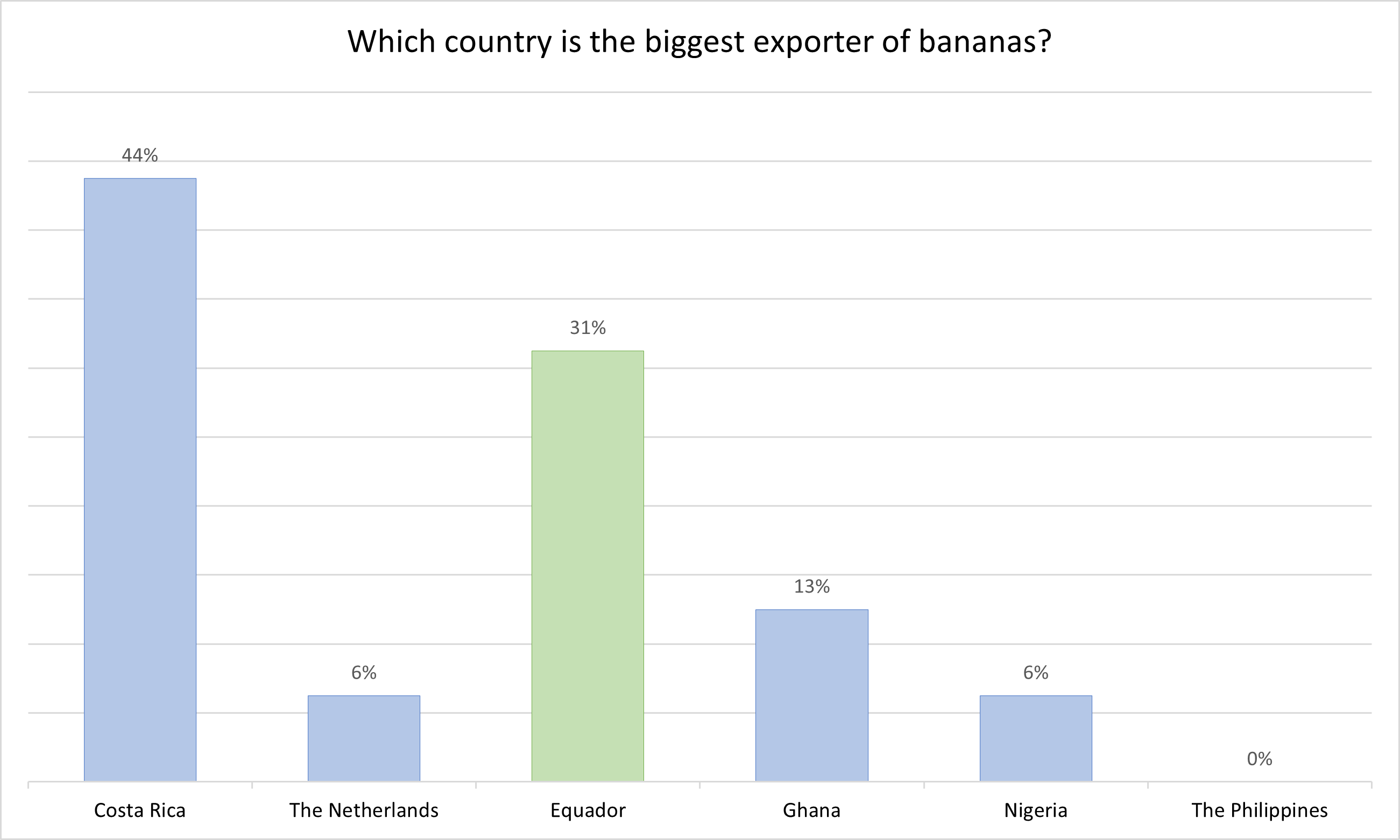

As an introduction to the topic, the audience responded to one poll question:

Top Banana exporting Countries, 2016

As an introduction to the topic, the audience responded to one poll question:

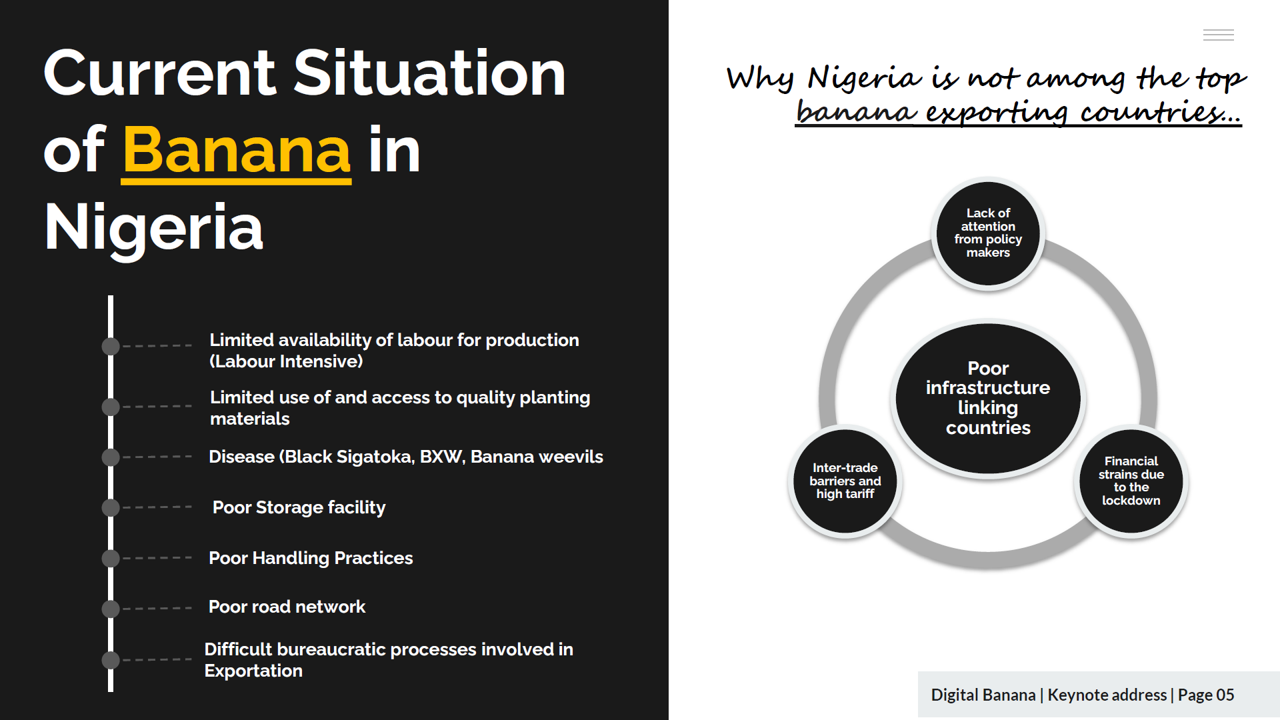

African countries are missing in the top-10 of banana exporting countries. “Why do we not see African countries, like Nigeria and Ghana, on the global banana trading map?”, moderator Tiffany Tsui asks strikingly. The first speaker, Babatunde Olarewaju, can help to answer this question for Nigeria. Babatunde - a young entrepreneur working for FutuX - helps smallholder farmers amongst others to collaborate, learn about the use of technology, receive training on good agricultural practices, and to meet exporter requirements.

Internal Challenges

“Bananas haven’t been exploited in Nigeria, due to its challenges”, Babatunde starts. “The key problem is the limited use of and access to quality planting materials. It’s very difficult for smallholders farmers to access different varieties. Therefore many farmers depend on cuttings from the mother plants, which are infected – for instance with Black Sigatoka. Its genetics can already contain diseases. This will affect the yield of the bananas.” Essentially, banana growers don’t start with a good and healthy basis.

Secondly, Babatunde mentions poor logistics: “We still experience over 40 to 70 percent post-harvest losses. (Nigeria produces 810.000 tons of bananas annually.) There is no storage facility and the infrastructure is very poor.” Bananas should be sold within 6 days of harvest, Babatunde explains, otherwise “they will get wasted. The only way for us to preserve bananas is to dry them.” Further along the chain, food producers have little knowledge about and no equipment for handling bananas. “You see so many bruises in the process of transportation”, causing decay of the bananas.

Lastly, neither policy makers nor banks see potential in banana cultivation. “Exportation includes a difficult and long bureaucratic process.” On top of that the cost of transportation, especially for exporting, are so high, making local sales more attractive than exports.

The EU needs to understand it takes time to implement new MRL requirementsExporting barriers between Nigeria and Europe

“Next to internal barriers, we experience external barriers,” Babatunde continues. The changing EU policy of pesticide residue is one of them. “This is a big challenge. Many farmers cannot meet the new regulation of 0.01 mg/kg” – which was announced early 2020 for November that year. It can take years for pesticides to subside from the soil. “The EU needs to understand it takes time to implement new MRL (maximum residue level) requirements.” Moreover, to be able to comply to such standards, Nigerian farmers need to have access to the new category of green pesticides: “We need alternatives to control the pests.” Producers of alternatives need to see that Nigeria and other African countries are interesting markets for them, Babatunde states.

“On average farmers aren’t compensated sufficiently for their effort. The price EU companies pay for bananas is too low compared to the requirements”, Babatunde declares. For farmers to overcome the challenges and comply to EU requirements, “there must be a minimum price when buying from Nigerian farmers. Price is an incentive for growers to put in more effort and to do the right thing.”

“We need commitment by the EU buyers.” Babatunde reckons transparency and tracking of produce, activities, and finances can help here. “True Code can track if farmers are compensated properly.” Moreover, “a quality management system can go a long way to ensure quality consistency of all the products”, Babatunde ends his talk.

Public-private partnership

Public-private partnership (PPP) can help to overcome challenges mentioned by Bababunde, Hugue Nkoutchou (Public Policy in Africa Initiative, Cameroon) suggests. In Cameroon, French investors have helped develop the local banana sector. “They do this in partnership with the government of Cameroon. This opens doors. Collaboration with the government makes the administration easier”, says Hugue. There is no difficult bureaucratic processes at the port – one of the challenges in Nigeria mentioned by Babatunde. Hugue illustrates: “On average it takes 21 days for goods to be exported from harbours in Nigeria and Cameroon. In Africa’s most efficient one, in Durban (South Africa), it is 3 days.” Partnering with the government can decrease this time significantly. “I believe in PPP’s,” Babatunde reacts from Nigeria, “but we shouldn’t give the government too much power, or they will take over the whole partnership.”

Agro Verified: Sellers can show their customers how the sales of their product can directly impact the lives of the smallholder farmersTransparency with Agro Verified

Victoria Madedor (African Farmers Stories) – the second speaker – talks about the Agro Verified initiative after her short introduction of African Farmers Stories. The organization tells the real stories of real African farmers, as they are not being portrayed correctly in the mainstream media. Farmers work and invest their butts off, but need to create the public infrastructure to start blooming.

The digital platform Agro Verified tries to “aggregate and optimize the data of African farmers to provide opportunities, visibility, and new markets to farmers across the continent.” The platform can be a direct link between investors and farmers. Currently investors have no insight into information about raw materials in Nigeria. “If they want to obtain this, they need to go through several layers of bureaucracy”, says Victoria.

“We provide a unique database for farmers in Nigeria that will help to stimulate trade, fair trade”, Victoria believes. “A unique identification number will provide integrity and transparency in the system.” With this number, the story behind produce can be traced. “Sellers can show their customers how the sales of their product can directly impact the lives of the smallholder farmers”, illustrates Victoria.

The use of data and technology Victoria describes can help to overcome challenges and organize capital for smallholder entrepreneurs. “Through collaboration with True Code, we believe that we can show how carbon credits can be used by smallholder farmers in Nigeria. We can also show transparently how fair trade is improved in Nigeria. It is possible to verify if they get the fairest of trade to improve their life, or the best kind of raw materials that is required to grow a product in a sustainable way”, Victoria concludes.

True Code

The True-code concept initiated by the Consumers Goods Forum serves as a unique identifier and basic set of data for every facility that plays a role in a supply chain. Enabling interoperability between existing databases and supporting transparency until the (small-holder) suppliers in the first mile of World Wide Supply Chains. A free facility passport that offers opportunities for all: end2end.

The True-code concept initiated by the Consumers Goods Forum serves as a unique identifier and basic set of data for every facility that plays a role in a supply chain. Enabling interoperability between existing databases and supporting transparency until the (small-holder) suppliers in the first mile of World Wide Supply Chains. A free facility passport that offers opportunities for all: end2end.

Beyond the cooperative, the identification of the smallholder is lackingTrue Code helps to solve Bottlenecks

Moderator Tiffany asks Marjan de Bock-Smit (developer the TRUE Code, founder ImpactBuying, and former CEO SIM Supply) to respond to both presentations. Marjan starts by giving an insight into European retail. She talks about the competition between retailers, the role bananas play in this competition, and the way consumers choose.

Marjan: “There is a fierce competition between retailers. Bananas are one of the biggest ultra-fresh products in Europe. It is a crop that attracts consumers to the shop. When asked about sustainability, consumers will speak with their hearts, but they buy with their wallet. Moreover, Western consumers are spoiled to the bone. They have very high requirements.”

In this landscape Marjan sees an opportunity for True Code’s identification and storytelling: “Beyond the cooperative, the identification of the smallholder is lacking.” Marjan sees an increase of the pressure on Western retailers to deliver a trusted story about fair prices and limited environmental impact. Such a story “can help consumers to make an informed decision. I know there is a need for a story that goes with a product, a need for products with data. True Code helps to give a face or an identification to every individual smallholder farmer.”

We as initiators [of True Code] aim for a better and fairer value distribution among the supply chain“We as initiators [of True Code] aim for a better and fairer value distribution among the supply chain”, Marjan states. True Code can enable an integrated, connected chain of all parties involved in for instance the banana chain. Through True Code these parties can prove complying to pre-determined requirements, making the retailer pay a premium based on this proof.

Marjan is looking for retailers and brands to scale the True Code initiative, for starters with coffee, bananas, and meat and soy. “We receive a lot of support from retailers and brands that buy large quantities of commodities. One of the tracks will work on fair value chain distribution. Another group will look into access to finance and how True Code can play a role there.”

Regional Infrastructure

Dr Ikechi Agbugba (Rivers State University, Nigeria) highlights the importance of regional infrastructure for a country’s economic growth. “Transportation costs in Africa are recorded to be the highest in the world.” However, improving roads, railways and ports in itself is not enough to enhance the efficiency of production, transportation, and communication within the region. But it will be a crucial incentives to public and private sector participants. “It will trickle down to economy wide growth.”

The new range of green pesticides can be used as a requirement that offers a Western supermarket the opportunity to differentiate its offeringIntimate Chat

Founder of Foodlog and AgriFoodNetworks Dick Veerman concludes the session. “In this session we have analyzed both in a practical way and from a policy point of view the problems of developing African agriculture.” Dick is impressed by the intimacy of the chat – that people feel comfortable to discuss delicate problems.

In his summary Dick goes into the topic of green pesticides, a topic he is familiar with, especially in The Netherlands. The new range of green pesticides can be used as a requirement that offers a Western supermarket the opportunity to differentiate its offering. That, in turn, can be an opportunity for growers in Africa, Dick says.

Simone Herzberg (former Safety and Quality assurance Dutch supermarket Albert Heijn, currently Chairperson of the Sustainable Nut Initiative) confirms that Western Retailers want to be involved in improving the situation for smallholders in less developed countries. New EU regulation will help: “The EU is making it legally binding for the whole chain to look back into the chain, allowing them to care what happens in the step before them. This legislation shows that it is important to care where your products come from. The next step is to let the consumer pay for that.”

Carbon Credits

Another way to help countries with poor infrastructure that need to build capital is to grand them with carbon credits. Dick: “Africa has lots of perennial crops. The fun of carbon credits is that you can store carbon in crops you don’t export. You don’t need any physical infrastructure to trade carbon credits. That will be the topic of our next session. How to unleash capital from the plots of land smallholders own?”

Join the Conversation - Carbon Credits

Access to finance by smallholder farmers is a huge challenge as indicated by Victoria Madedor (African Farmers Stories) and Babatunde Olarewaju (Futux Agri Consult, Lagos, Nigeria). Let’s start to explore if and how carbon credits can help raise capital farmers already own but cannot activate.

Join us on Tuesday, March 30, from 1:30 PM till 2:15 PM (CET) + 45 more minutes of informality (if you care to stay on) for the sixth chat in the Digital Food series. Tiffany Tsui will talk with her guests about carbon credits and capital for African smallholder entrepreneurs. As Africa is a continent that grows a variety of perennial crops, storing carbon offers opportunities for farmers to access capital they already own.

Access to finance by smallholder farmers is a huge challenge as indicated by Victoria Madedor (African Farmers Stories) and Babatunde Olarewaju (Futux Agri Consult, Lagos, Nigeria). Let’s start to explore if and how carbon credits can help raise capital farmers already own but cannot activate.

Join us on Tuesday, March 30, from 1:30 PM till 2:15 PM (CET) + 45 more minutes of informality (if you care to stay on) for the sixth chat in the Digital Food series. Tiffany Tsui will talk with her guests about carbon credits and capital for African smallholder entrepreneurs. As Africa is a continent that grows a variety of perennial crops, storing carbon offers opportunities for farmers to access capital they already own.

REGISTER HERE

Upon registration (Free! - the first rounds are on the house) you will receive a link to the ZOOM-chat.

Upon registration (Free! - the first rounds are on the house) you will receive a link to the ZOOM-chat.

Related