It is important to note that major sectors comprise of agribusiness inputs, agribusiness outputs, and agricultural services. The agribusiness input sector essentially includes all resources involved in producing farm commodities such as the seed, fertilizer, machinery, fuel and credit. It elucidates the production and operations of a farm, the manufacture and distribution of farm equipment and supplies, as well as the processing, storage, and distribution of farm commodities. Hence, agriculture which entails agricultural production and management, is clearly the core of Africa’s agribusiness space. Dr Ikechi Agbugba highlights on some of the factors to consider in boosting African agribusinesses.

Indeed, it is always a good and welcome idea to learn from nations that are thriving in agribusiness. In fact, most countries that have developed successfully and worked on the whole agribusiness value-chain from the point of production to marketing would need to be commended.

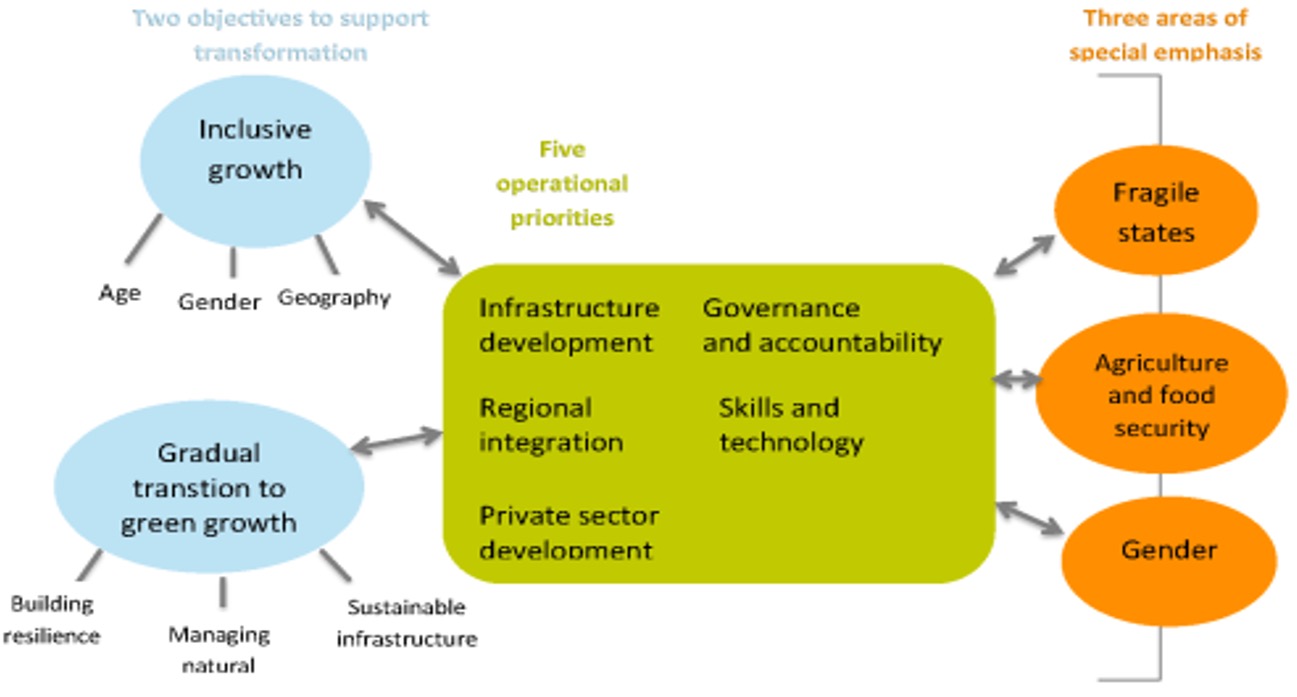

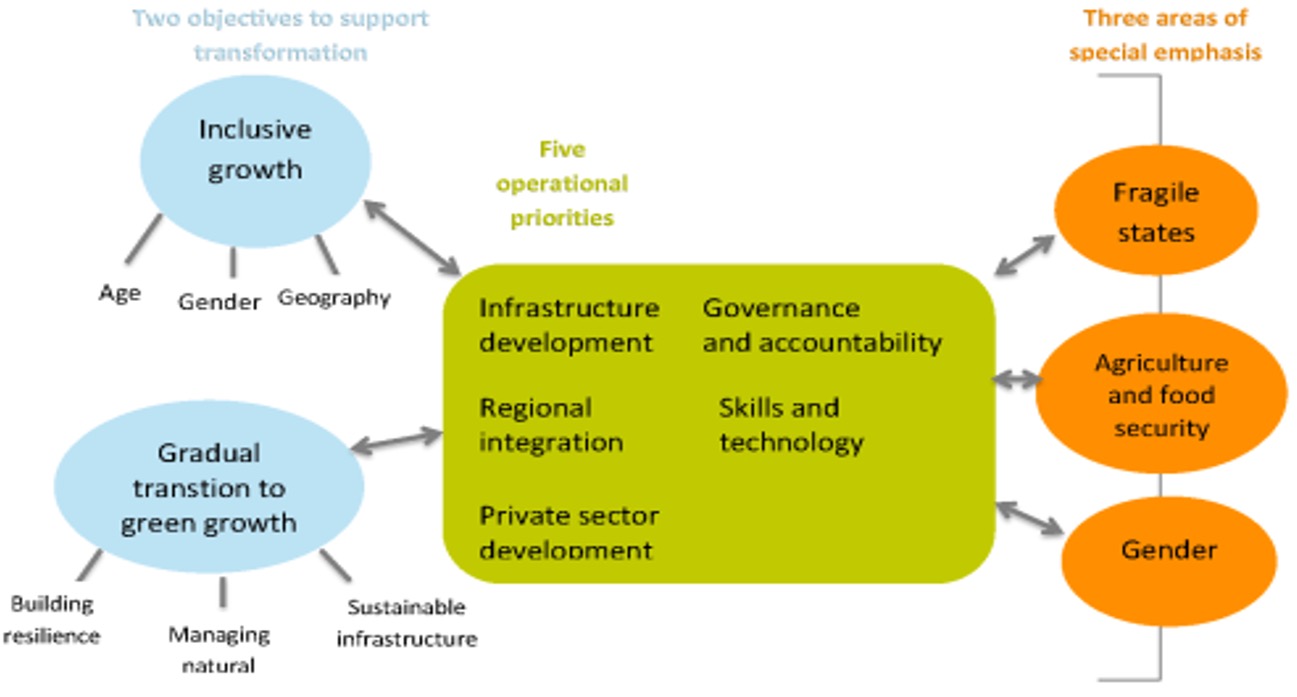

Figure 1.0: Africa’s Agriculture Sector:

Core Focus of African Development Bank for 2013 – 2022

Enhancing agricultural productivity

Low productivity of African agriculture can be attributed largely to the limited use of industrial inputs, as well as significant post-harvest losses resulting from inadequate storage, packaging and transport facilities in the following areas.

Upgrading of food and Agri value-chains

Successful agribusiness growth depends on improvements along the value chain from efficient post-harvest policies to technologies in processing, storage, packaging, transport, marketing and distribution. Participation in modern value chains can increase farmers’ income by between 10 and 100 per cent according to evidence from Guatemala, Indonesia and Kenya (World Bank 2007a). The transformation of agricultural raw materials into industrial products depends increasingly on the capacity of African entrepreneurs to participate in global, regional and local value-chains.

Exploiting local, regional and international demand

Although emerging market exports have expanded very rapidly in recent decades, growth has been fastest in manufacturing and much slower in agriculture, where significant protection remains. Using data from the 1980 to 2001 period, concludes that although there have been far-reaching changes in global trading patterns in the past 25 years, there has been “relatively little structural change” in global agricultural trade flows (Aksoy & Ng 2010). Progress towards the liberalization of agricultural trade has been slow and fitful with some reverses in recent years, notably in emerging markets. The Uruguay Round of 1995 failed to secure any meaningful reductions in agricultural protection in developed countries, though there has been movement in the early 2000s, arising mostly from the strong increase in food and other agricultural commodity prices in recent years.

Strengthening technological effort and innovation capabilities

Technological change takes two distinct forms, learning-by-doing, and research and development (R&D) expenditure in innovation, and is crucial for the development of agribusiness in Africa. Learning-by-doing is technological change derived from experience: an increase in inputs used generates a higher input productivity as individuals become more efficient over time (Lall, 1987). Learning by doing is said to be a ‘free cost’ in the sense that productivity is increased without specific investment in R & D. In fact, ‘free cost’ is a misnomer because learning-by-doing effects are not automatic.

Promoting effective and innovative financing

Promoting financing and investment in agribusiness requires attention to two critical areas:

(a) facilitating pooled funding for agribusiness that uses the public sector to leverage resources from the private sector,

(b) and creating the enabling conditions for local resource accumulation and investment.

Concerning the first issue, the key to unleashing resources from the private sector is to increase profitability, reduce risk and mobilize both traditional and innovative sources of finance. In this regard, it is important to emphasize that long-term investment can be promoted most efficiently in locations that have favorable investment climates and enabling infrastructure. These factors combined with solid agricultural supply, and innovation capabilities leads to competitive value chain operations. Efforts will need to focus on large-scale resource mobilization, as well as improvements in financial infrastructure, innovative models, and building capacities in the system. Some of the more traditional measures for improving the situation for financing of agribusiness development comprise domestic resource mobilization; funding from development finance institutions (DFI); and targeting foreign direct investment (FDI). Some of the more innovative financing tools and models include the creation of dedicated sovereign wealth funds (SWF); leveraging diasporas for investment; expanding collateralization and encouraging leasing; developing appropriate banking models and regulations including risk mitigation through insurance and reinsurance schemes; external finance through large lead firms in value chains; and provision of equity, venture and hybrid finance.

Core Focus of African Development Bank for 2013 – 2022

Enhancing agricultural productivity

Low productivity of African agriculture can be attributed largely to the limited use of industrial inputs, as well as significant post-harvest losses resulting from inadequate storage, packaging and transport facilities in the following areas.

Upgrading of food and Agri value-chains

Successful agribusiness growth depends on improvements along the value chain from efficient post-harvest policies to technologies in processing, storage, packaging, transport, marketing and distribution. Participation in modern value chains can increase farmers’ income by between 10 and 100 per cent according to evidence from Guatemala, Indonesia and Kenya (World Bank 2007a). The transformation of agricultural raw materials into industrial products depends increasingly on the capacity of African entrepreneurs to participate in global, regional and local value-chains.

Exploiting local, regional and international demand

Although emerging market exports have expanded very rapidly in recent decades, growth has been fastest in manufacturing and much slower in agriculture, where significant protection remains. Using data from the 1980 to 2001 period, concludes that although there have been far-reaching changes in global trading patterns in the past 25 years, there has been “relatively little structural change” in global agricultural trade flows (Aksoy & Ng 2010). Progress towards the liberalization of agricultural trade has been slow and fitful with some reverses in recent years, notably in emerging markets. The Uruguay Round of 1995 failed to secure any meaningful reductions in agricultural protection in developed countries, though there has been movement in the early 2000s, arising mostly from the strong increase in food and other agricultural commodity prices in recent years.

Strengthening technological effort and innovation capabilities

Technological change takes two distinct forms, learning-by-doing, and research and development (R&D) expenditure in innovation, and is crucial for the development of agribusiness in Africa. Learning-by-doing is technological change derived from experience: an increase in inputs used generates a higher input productivity as individuals become more efficient over time (Lall, 1987). Learning by doing is said to be a ‘free cost’ in the sense that productivity is increased without specific investment in R & D. In fact, ‘free cost’ is a misnomer because learning-by-doing effects are not automatic.

Promoting effective and innovative financing

Promoting financing and investment in agribusiness requires attention to two critical areas:

Concerning the first issue, the key to unleashing resources from the private sector is to increase profitability, reduce risk and mobilize both traditional and innovative sources of finance. In this regard, it is important to emphasize that long-term investment can be promoted most efficiently in locations that have favorable investment climates and enabling infrastructure. These factors combined with solid agricultural supply, and innovation capabilities leads to competitive value chain operations. Efforts will need to focus on large-scale resource mobilization, as well as improvements in financial infrastructure, innovative models, and building capacities in the system. Some of the more traditional measures for improving the situation for financing of agribusiness development comprise domestic resource mobilization; funding from development finance institutions (DFI); and targeting foreign direct investment (FDI). Some of the more innovative financing tools and models include the creation of dedicated sovereign wealth funds (SWF); leveraging diasporas for investment; expanding collateralization and encouraging leasing; developing appropriate banking models and regulations including risk mitigation through insurance and reinsurance schemes; external finance through large lead firms in value chains; and provision of equity, venture and hybrid finance.